FAQ's Homeownership

Who is eligible?

Who is eligible?

- Applicants must currently hold a Housing Choice Voucher and have completed at least a 12 month initial lease with Augusta Housing or with another PHA.

- Applicants must be in good standing and have a good rental history.

- Applicants under the age of 62 who are not disabled must be currently be enrolled or have successfully completed the Family Self Sufficiency Program.

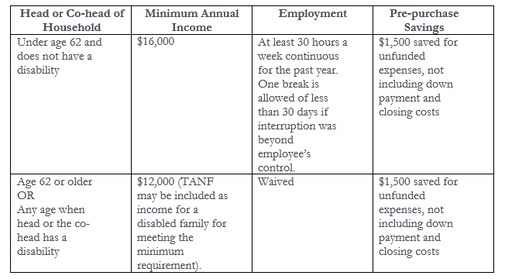

What are the income and savings requirements?

What can I expect in homeownership costs?

You will need money for pre-closing costs. These include an independent home inspection, homeowners insurance, and earnest money. You may also need to cover closing costs unless eligible for grant funding, seller concessions, or a gift. You will need to be able to cover the ongoing costs of homeownership. These include utilities, maintenance, and repairs.

Do I need to take a Homebuyer's class?

You will need to complete an approved homebuyer’s education program within 24 months prior to your purchase. A list of classes can be found on the Maine Housing website: www.mainehousing.org/education/home/homeworks-homebuyer-education-classes

What kind of financing do I need?

The family is responsible for securing its own financing. Augusta Housing will work with direct government loans and with approved lenders. Augusta Housing will prohibit the following forms of financing: Balloon Payment Mortgages, Variable Interest Rate Loans, Seller Financing, and Interest-first Mortgages. Augusta Housing has final approval as to whether the financing arrangement is affordable and within the parameters of the program.

What kind of homes are eligible?

The home must be a single-family dwelling in the Augusta Housing Catchment Area. Units must have an independent inspection and a Housing Quality Inspection. If it is a mobile home, it must be on an approved permanent foundation and be on property that is either owned by the homebuyer or on land which the buyer has the right to occupy for 40 years. No multi-unit homes may be purchased using this program.

What is the timeline for assistance?

Nondisabled or non-elderly households may continue to receive assistance with their mortgage under this option for a maximum of 15 years for mortgages of 20 years or more. In all other cases, the maximum is 10 years. Disabled and elderly households will receive assistance for the life of their mortgage.

You will need money for pre-closing costs. These include an independent home inspection, homeowners insurance, and earnest money. You may also need to cover closing costs unless eligible for grant funding, seller concessions, or a gift. You will need to be able to cover the ongoing costs of homeownership. These include utilities, maintenance, and repairs.

Do I need to take a Homebuyer's class?

You will need to complete an approved homebuyer’s education program within 24 months prior to your purchase. A list of classes can be found on the Maine Housing website: www.mainehousing.org/education/home/homeworks-homebuyer-education-classes

What kind of financing do I need?

The family is responsible for securing its own financing. Augusta Housing will work with direct government loans and with approved lenders. Augusta Housing will prohibit the following forms of financing: Balloon Payment Mortgages, Variable Interest Rate Loans, Seller Financing, and Interest-first Mortgages. Augusta Housing has final approval as to whether the financing arrangement is affordable and within the parameters of the program.

What kind of homes are eligible?

The home must be a single-family dwelling in the Augusta Housing Catchment Area. Units must have an independent inspection and a Housing Quality Inspection. If it is a mobile home, it must be on an approved permanent foundation and be on property that is either owned by the homebuyer or on land which the buyer has the right to occupy for 40 years. No multi-unit homes may be purchased using this program.

What is the timeline for assistance?

Nondisabled or non-elderly households may continue to receive assistance with their mortgage under this option for a maximum of 15 years for mortgages of 20 years or more. In all other cases, the maximum is 10 years. Disabled and elderly households will receive assistance for the life of their mortgage.

What else should I know?

- No family member has a present ownership interest in a residence at the commencement of homeownership assistance for the purchase of a home, except for cooperative members who have acquired cooperative shares prior to commencement of homeownership assistance.

- Applicant or other adult member has not defaulted on a mortgage securing debt to purchase a home under a HCV Homeownership Program.

- Applicant must be a first time homebuyer. Augusta housing defines a first-time homebuyer as a family of which no member owns any present ownership interest in a residence during the three years prior to receiving homeownership assistance. You can be considered a first-time homebuyer if you are a single parent or displaced homemaker who, while married, owned a home with your spouse, or resided in a home owned by your spouse.

For more information or to apply click the link below.